In the startup ecosystem, Product Market Fit has long been the first milestone of maturity: proving that a product truly meets a real market need.

But today, in a more selective and competitive landscape, having a good product is no longer enough to grow.

A startup may have a strong team, a promising technology and a receptive market yet still fail to scale.

The reason is often not execution or timing but the lack of alignment with the right investors.

This is where the concept of Investor Market Fit comes into play: the coherence between a company’s vision and the investment thesis of those able to support it over time.

In other words, the point where innovation meets capital.

Investor Market Fit measures how well a startup aligns with the priorities, timelines and strategies of its potential investors.

It’s not about fundraising but about building a coherent growth strategy.

A startup with strong Investor Market Fit:

In a funding environment where capital is concentrated in fewer but larger rounds the alignment between innovation, market and capital has become the key growth driver.

The transition from Seed to Series A is now the main bottleneck for European startups.

According to “The Journey to Series A in Europe” by Dealroom, among more than 6,500 startups analyzed only 19% reach a Series A round within 36 months of their Seed with a median time of 18 months.

The research highlights several critical insights:

These findings show that the real differentiator is not the availability of capital but strategic alignment with the right capital.

Achieving the right investor fit is what turns potential into scalability.

Investor Market Fit is not achieved through a single pitch.

It’s the result of a structured process combining vision, method and a deep understanding of capital.

Venture Studios serve as a bridge between innovation and capital.

They help founders and researchers design ventures that are investor-ready from day one.

By combining technological development, market validation and access to strategic investors they reduce execution risk and accelerate the path to scalability.

Within e-Novia’s model the Venture Studio goes beyond supporting growth: it designs alignment between vision and capital from the ideation phase creating startups built to attract the right investors for their industrial mission.

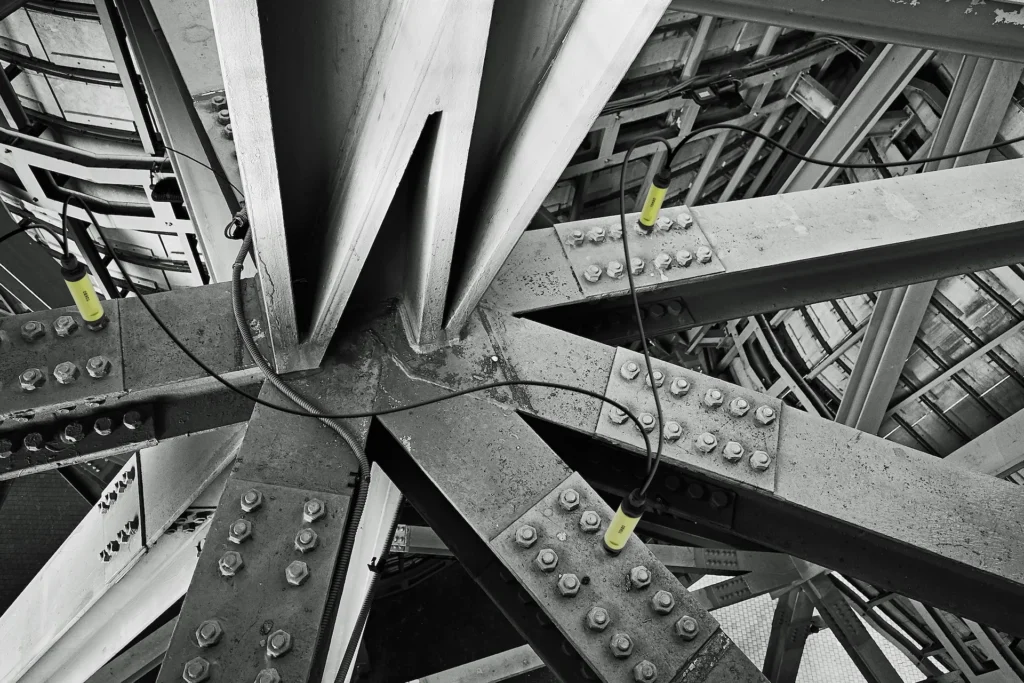

A concrete example of Investor Market Fit in action is Tokbo, a joint venture between Agrati Group, a global leader in fastening solutions for the automotive industry and e-Novia, a Venture Studio transforming innovations in Physical AI into scalable companies.

The project emerged from Agrati’s goal to diversify its core business and bring digital intelligence to traditional mechanical components.

The initial intuition born during an Innovation Bootcamp evolved into an advanced technology: sensorized bolts capable of measuring force, vibration and temperature while transmitting data to a central platform for predictive maintenance and structural monitoring.

The development journey began in 2019 with the concept definition moving through proof of concept, prototyping and industrial validation phases until 2023 when the project entered the scaling stage.

Today Tokbo operates across more than 15 European infrastructures enabling new services in safety and smart maintenance.

Tokbo exemplifies how the combination of industrial vision and capital alignment can transform a research concept into a high-potential industrial venture.

e-Novia operates as a Venture Studio dedicated to Physical AI with the mission of transforming research into industrial value.

Through an ecosystem that connects universities, investors and industrial partners the group guides founders and researchers in building startups that combine technological solidity, market validation and capital coherence.

In venture building the key question is no longer just “Is there a market for this product?” but also “Is there an investor who shares this vision of the future?”

It’s the strategic alignment between a startup’s vision and the investment thesis of the investors supporting it over time.

Meeting market demand is essential but insufficient. Sustainable growth requires capital aligned with the company’s vision and timing.

By combining market validation, industrial credibility and strategic dialogue with investors throughout the growth process.

It supports founders and researchers in merging technological development, market validation and access to strategic investors to build scalable companies.

👉 Discover how e-Novia helps companies and researchers build startups that combine Product Fit and Investor Fit turning innovation and capital into sustainable growth.

Learn more about our Venture Studio →